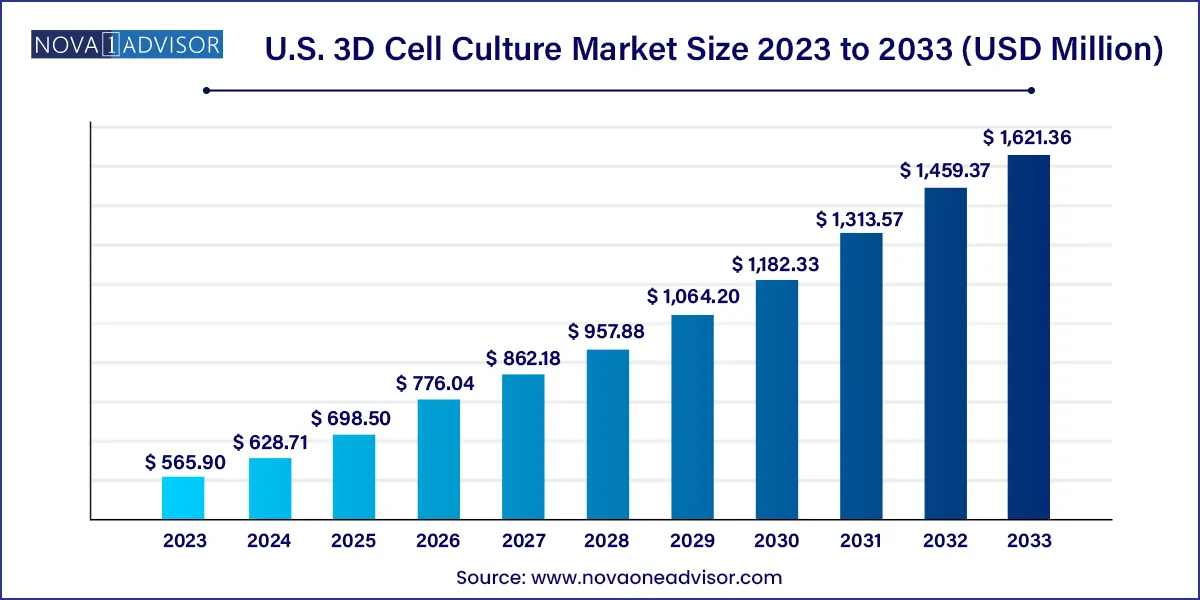

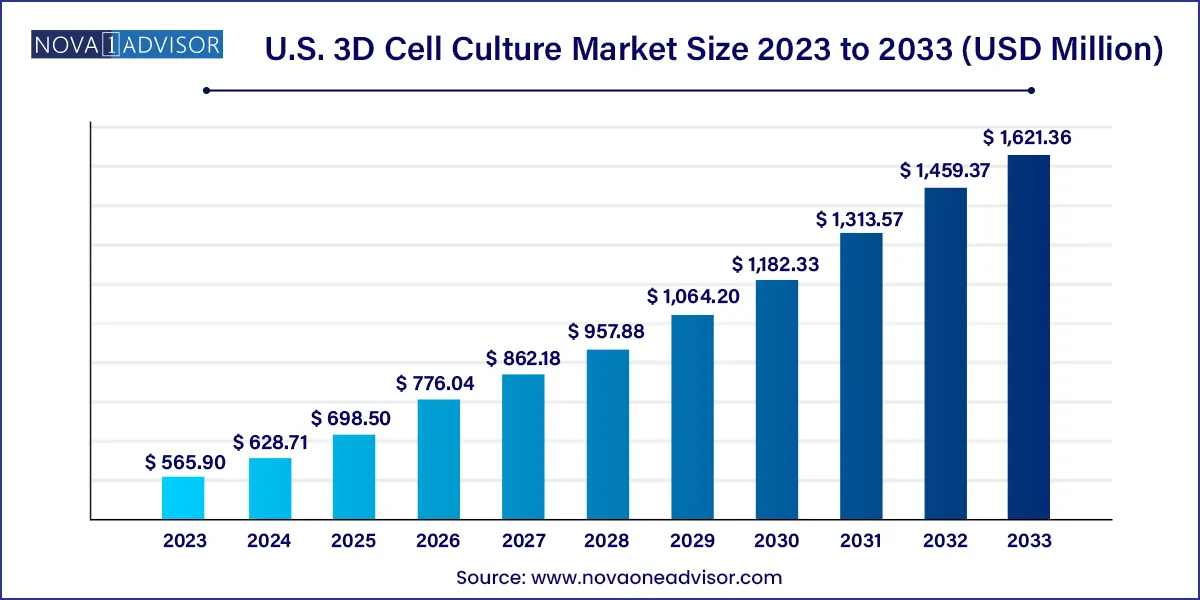

The U.S. 3D cell culture market size was estimated at USD 565.90 million in 2023 and is projected to hit around USD 1,621.36 million by 2033, growing at a CAGR of 11.1% during the forecast period from 2024 to 2033.

Key Takeaways:

- The scaffold-based segment held the largest market share of 48.19% in 2023.

- The scaffold free segment is likely to register the fastest CAGR during the forecast period.

- The stem cell research & tissue engineering segment dominated the market with a share of 34.9% 2023.

- The cancer research segment is expected to register the fastest CAGR over the forecast period.

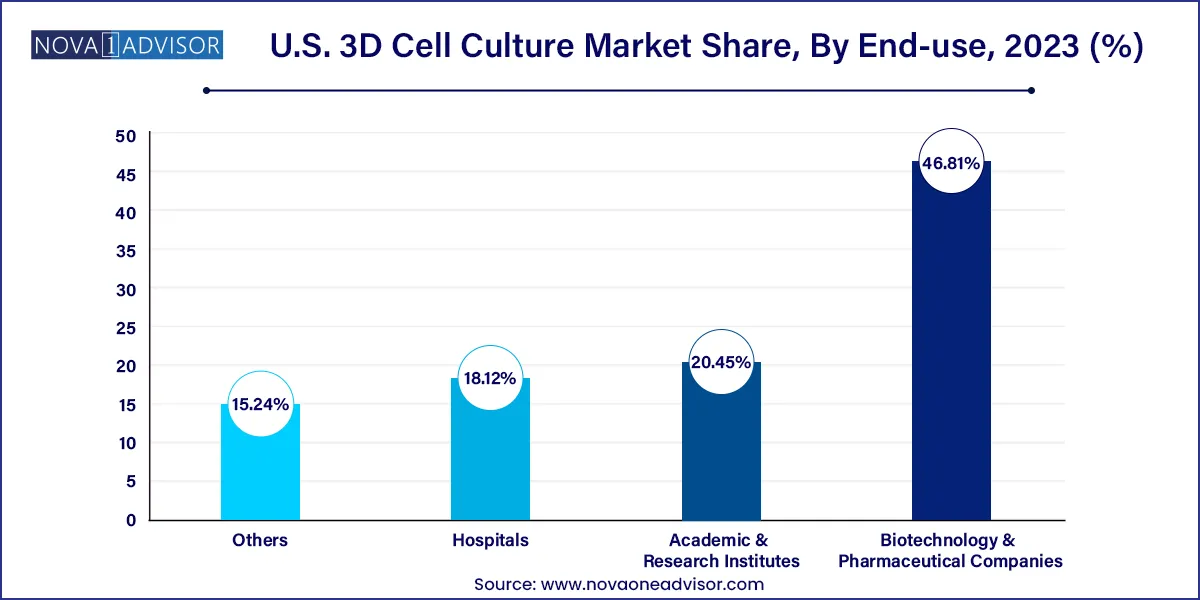

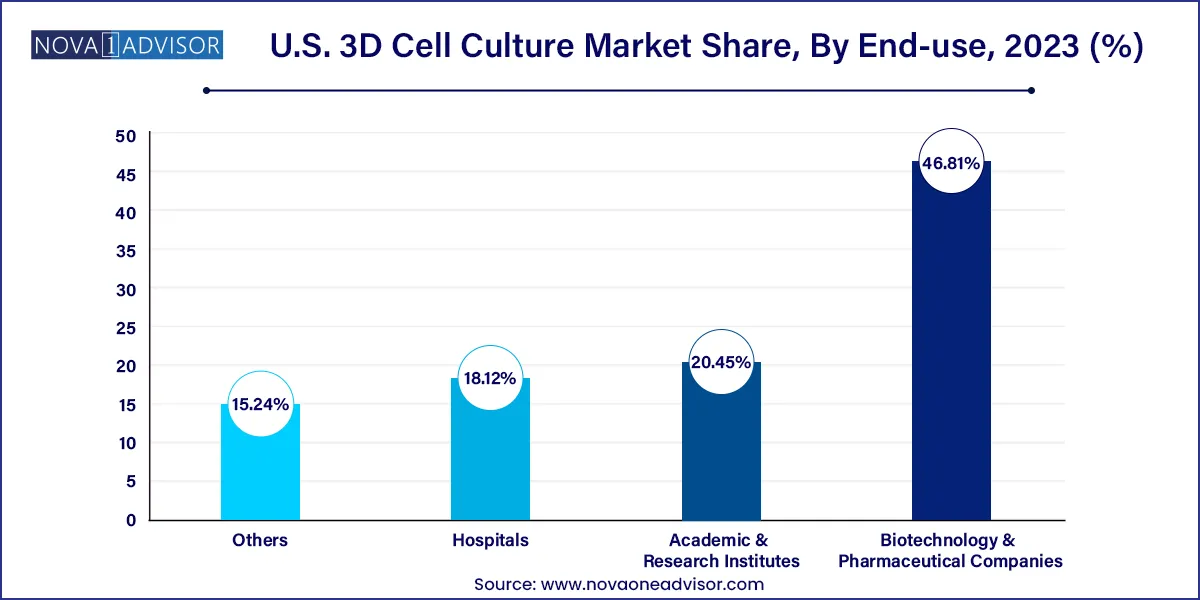

- The biotechnology & pharmaceutical companies segment dominated the market with a share of 46.81% in 2023.

- The academic & research institutes segment is expected to register the fastest CAGR during the forecast period.

U.S. 3D Cell Culture Market Overview

The U.S. 3D cell culture market has rapidly evolved from a niche segment within life sciences to a cornerstone of modern biomedical research and drug development. Unlike conventional 2D monolayer cell cultures, 3D cell culture systems enable cells to grow in all directions, more closely mimicking the architecture and physiological environment of human tissues. This capability provides deeper insights into cellular interactions, disease progression, and therapeutic responses, transforming how scientists evaluate drug candidates and understand human biology.

A confluence of technological innovation, rising focus on personalized medicine, and the demand for physiologically relevant in vitro models has been instrumental in shaping the growth trajectory of this market. From cancer research and regenerative medicine to high-throughput drug screening, 3D cell cultures are increasingly replacing traditional methods due to their superior predictive power. Their application is particularly valuable in areas like oncology, where tumor spheroids allow better simulation of in vivo conditions, leading to more reliable preclinical data.

The U.S., home to some of the world’s most advanced pharmaceutical R&D infrastructures, continues to dominate the global 3D cell culture space. Its extensive network of research institutions, top-tier biotech firms, and federal funding initiatives has created a fertile environment for the proliferation of these advanced technologies. The support from regulatory bodies such as the FDA in validating organoid-based or 3D-culture-based assays as part of Investigational New Drug (IND) applications further underscores the market's legitimacy and growth potential.

Major Trends in the Market

-

Integration of Bioprinting with 3D Cell Culture: The fusion of bioprinting technologies with 3D cell culture allows for the creation of tissue-like constructs with unprecedented accuracy, aiding in regenerative medicine and organ-on-chip models.

-

Adoption of Scaffold-Free Techniques: Scaffold-free approaches, including magnetic levitation and hanging drop microplates, are gaining traction due to their simplified workflow and ability to maintain native cellular interactions.

-

Expansion of Microfluidic Platforms: Microfluidics, or “organ-on-chip” systems, are becoming central to drug testing and disease modeling by mimicking blood flow and mechanical stress factors in vitro.

-

Rising Use in Personalized Medicine: Organoid technology and patient-derived spheroids are being increasingly used to simulate individual treatment responses, especially in oncology.

-

Artificial Intelligence (AI) for Culture Analysis: AI and machine learning tools are being used to analyze large datasets from 3D cultures for enhanced drug screening and toxicity prediction.

-

Public-Private Partnerships: Collaboration between government-funded research bodies and biotech companies is accelerating the development of next-generation culture systems.

-

Eco-friendly and Defined Scaffold Materials: Biodegradable and xeno-free scaffolds are being developed for more sustainable and regulatory-compliant 3D cultures.

U.S. 3D Cell Culture Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 628.71 Million |

| Market Size by 2033 |

USD 1,621.36 million |

| Growth Rate From 2024 to 2033 |

CAGR of 11.1% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, application, end use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; Lena Biosciences. |

Market Driver: Increasing Demand for Predictive Drug Screening Models

A key driver for the U.S. 3D cell culture market is the escalating demand for more predictive, human-relevant models in drug discovery. The high attrition rates of drug candidates particularly in oncology have highlighted the limitations of 2D culture systems and animal models in mimicking human physiology. As a result, pharmaceutical and biotech companies are increasingly investing in 3D culture systems to identify promising candidates earlier in the development process.

For instance, cancer spheroids derived from patient tumors can replicate the tumor microenvironment and heterogeneity, offering an in-depth understanding of drug response and resistance. This predictive power not only accelerates preclinical timelines but also minimizes the risk of late-stage failure. In the U.S., where the average cost of bringing a new drug to market exceeds $2 billion, the ability of 3D cultures to optimize resource allocation and improve R&D ROI is a compelling growth engine.

Market Restraint: High Operational Costs and Technical Complexity

Despite their scientific superiority, 3D cell culture systems are often associated with higher operational costs and greater technical complexity compared to traditional methods. Setting up bioprinting or microfluidic platforms requires expensive instrumentation, skilled personnel, and rigorous standardization protocols. This can pose significant entry barriers, especially for smaller biotech firms or academic labs with limited budgets.

Additionally, reproducibility remains a challenge. Variations in scaffold materials, culture conditions, and imaging protocols can lead to inconsistent results, undermining the reliability of the data. Regulatory acceptance, although improving, is still in early stages for certain applications. These challenges, coupled with longer learning curves and more demanding maintenance requirements, can deter potential adopters and limit wider market penetration in the short term.

Market Opportunity: Growth of Regenerative Medicine and Tissue Engineering

The rapidly advancing fields of regenerative medicine and tissue engineering offer significant growth opportunities for the U.S. 3D cell culture market. As researchers aim to create tissue substitutes and even whole organs, 3D cultures offer the structural and functional complexity required to build biologically relevant constructs. Bioprinting and scaffold-based methods have made it possible to fabricate skin, bone, and liver tissues, paving the way for clinical-grade tissue products.

With the FDA approving more cell and gene therapy trials in the U.S., the demand for robust and reproducible 3D culture models is set to skyrocket. These models can serve as intermediate steps in assessing therapeutic safety and efficacy, especially for autologous therapies. Moreover, academic collaborations with hospitals and startups are helping translate bench-side innovations into real-world treatments, especially in burn care and musculoskeletal repair. This positions 3D culture as an indispensable tool in the future of patient-specific therapeutic development.

U.S. 3D Cell Culture Market By Technology Insights

Scaffold-Based Technology dominated the U.S. 3D cell culture market, owing to its ability to provide structural support and enable cell attachment, proliferation, and differentiation. Hydrogels such as collagen, alginate, and Matrigel are particularly popular for mimicking the extracellular matrix. They facilitate organoid development, especially in oncology and gastrointestinal applications. Polymeric scaffolds and micropatterned microplates are also widely used for modeling tissue development and screening compounds under more naturalistic conditions. Their adaptability to various assays and compatibility with imaging platforms make scaffold-based technologies the foundation of 3D culture systems in the U.S.

Microfluidics and Bioprinting are the fastest-growing sub-segments, spurred by their capability to model dynamic environments and structural heterogeneity. Microfluidics systems, often referred to as “organ-on-chip” technologies, allow for precise control over cell culture conditions and enable real-time data generation. In the last few years, U.S. research institutes have increasingly adopted microfluidics to study diseases like lung fibrosis and neurodegeneration. Simultaneously, 3D bioprinting has gained momentum in tissue engineering by allowing researchers to deposit cells layer-by-layer to form complex tissues. Companies like CELLINK and Allevi (now part of 3D Systems) are making significant inroads in academic and commercial labs across the U.S.

U.S. 3D Cell Culture Market By Application Insights

Cancer Research is the dominant application, leveraging 3D culture models to study tumor heterogeneity, angiogenesis, metastasis, and drug resistance. Patient-derived organoids and tumor spheroids are particularly effective in screening immunotherapies, small molecules, and antibody-drug conjugates. Many U.S. cancer centers, such as MD Anderson and Dana-Farber, are integrating 3D systems into their preclinical pipelines to improve translational outcomes. These models also support personalized medicine, where patient-specific cells are tested against a panel of treatments to determine the most effective therapy.

Stem Cell Research & Tissue Engineering is emerging as the fastest-growing segment, supported by the increasing demand for regenerative therapies. The versatility of stem cells, combined with the spatial control offered by 3D scaffolds and bioprinters, enables the development of tissue-like structures for organ modeling and transplantation. Recent initiatives by institutions like the NIH's Regenerative Medicine Program are channeling federal support into this field, driving innovation and expanding the use of 3D culture in stem cell differentiation studies, especially for cardiac, hepatic, and neural tissues.

U.S. 3D Cell Culture Market By End Use Insights

Biotechnology and Pharmaceutical Companies lead the market in terms of adoption and investment. These companies use 3D cultures extensively in preclinical screening, toxicology assessment, and pharmacokinetics modeling. Companies like Pfizer, Merck, and Amgen are increasingly partnering with 3D culture technology firms to shorten discovery timelines and improve candidate selection. The ability to replicate complex disease models in vitro allows these players to reduce late-stage failures and optimize trial designs, especially in oncology and CNS drug development.

Academic and Research Institutes represent the fastest-growing end-user segment, as universities and government-backed labs push the boundaries of basic research. With NIH grants encouraging the use of advanced in vitro systems, institutes are using 3D culture for developmental biology, stem cell studies, and infectious disease modeling. The COVID-19 pandemic underscored the need for rapid, in vitro testing models, and many universities turned to 3D lung and airway models to study viral pathogenesis. This trend is expected to continue as precision biology becomes central to U.S. academic R&D initiatives.

Country-Level Analysis

The United States remains at the forefront of the 3D cell culture revolution, bolstered by a robust life sciences ecosystem, heavy federal funding, and cutting-edge academic research. Institutions like Harvard, MIT, and Stanford are driving innovation in scaffold materials, organoids, and microfluidic systems. Federal agencies, including the NIH and DARPA, have increased funding for 3D tissue models used in defense, regenerative medicine, and space biology.

In terms of commercial activity, the U.S. hosts a concentration of top global 3D cell culture technology providers and bioprinting startups. State-level biotech clusters in Massachusetts, California, and North Carolina further amplify innovation through public-private partnerships. Regulatory openness to integrating novel in vitro models in preclinical validation pipelines adds another layer of competitive advantage for U.S. firms, making the country both the largest producer and consumer of 3D cell culture products globally.

U.S. 3D Cell Culture Market Top Key Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

U.S. 3D Cell Culture Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. 3D Cell Culture market.

By Technology

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Base Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA Coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

By Application

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

By End Use

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others